hedge fund vs mutual fund

Mutual funds can easily be used as investment options by the general public because the minimum invested amount can be as low as Rs. Mutual funds only charge a management fee usually set between 1 and 2.

Difference Between Hedge Funds And Index Funds Difference Between

Whereas hedge funds have a lot fewer.

. Hedge funds have no requirements on its liquidity to its investors which adds another element of risk. Mutual funds refer to a professionally managed investment vehicle where the funds are collected from several investors are pooled together to purchase securities. Some funds allow monthly subscriptions and redemptions while some offer longer at quarterly and annual intervals.

Mutual funds are generally considered safer investments than hedge funds. Mutual funds dont invest in something that is open to wild speculations such as derivatives. Guide to Hedge Funds.

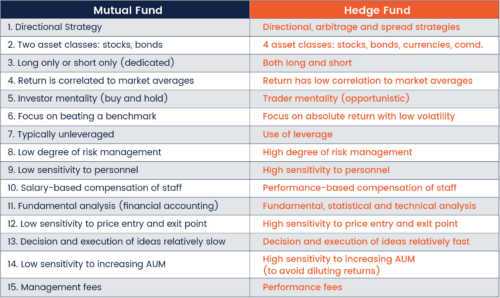

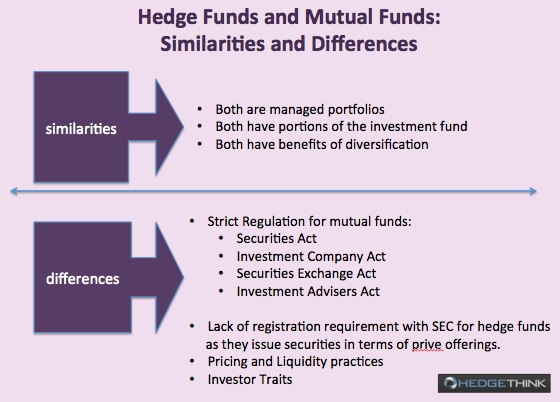

Most hedge funds are not registered and can only be sold to carefully defined sophisticated investors. Hedge funds make riskier investments using advanced investment methods while mutual funds are safer and invest in safer securities such as stocks and bonds. The main differences Mutual funds.

Hedge funds typically have much higher expenses than mutual funds. For instance a mutual fund is registered with the SEC and can be sold to an unlimited number of investors. Mutual funds are for individual investors using safer well-established strategies for.

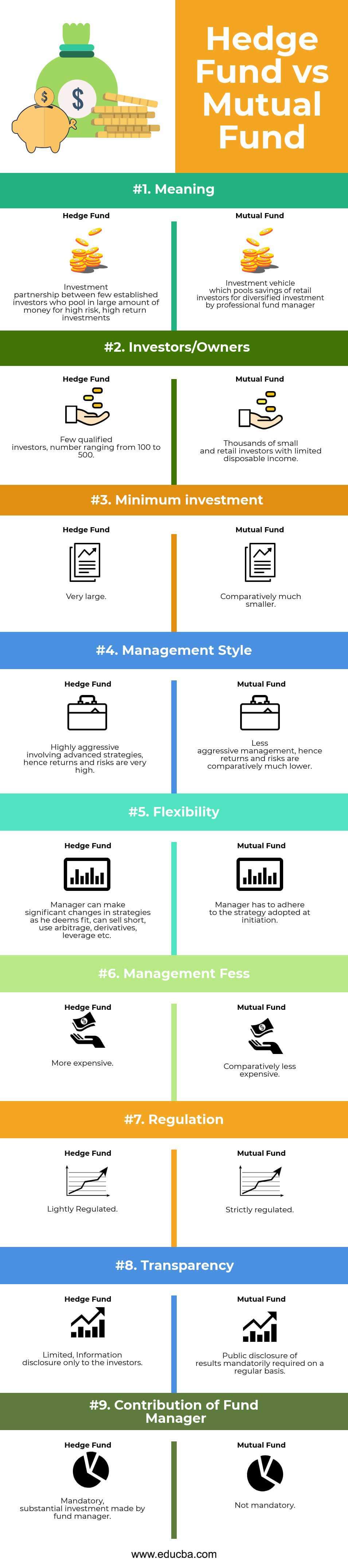

Most hedge funds are partnerships that have settled on a management fee and an incentive fee. Heres how they do it. As one might expect this can have a significant impact on the behavior of these managers sometimes in unexpected ways.

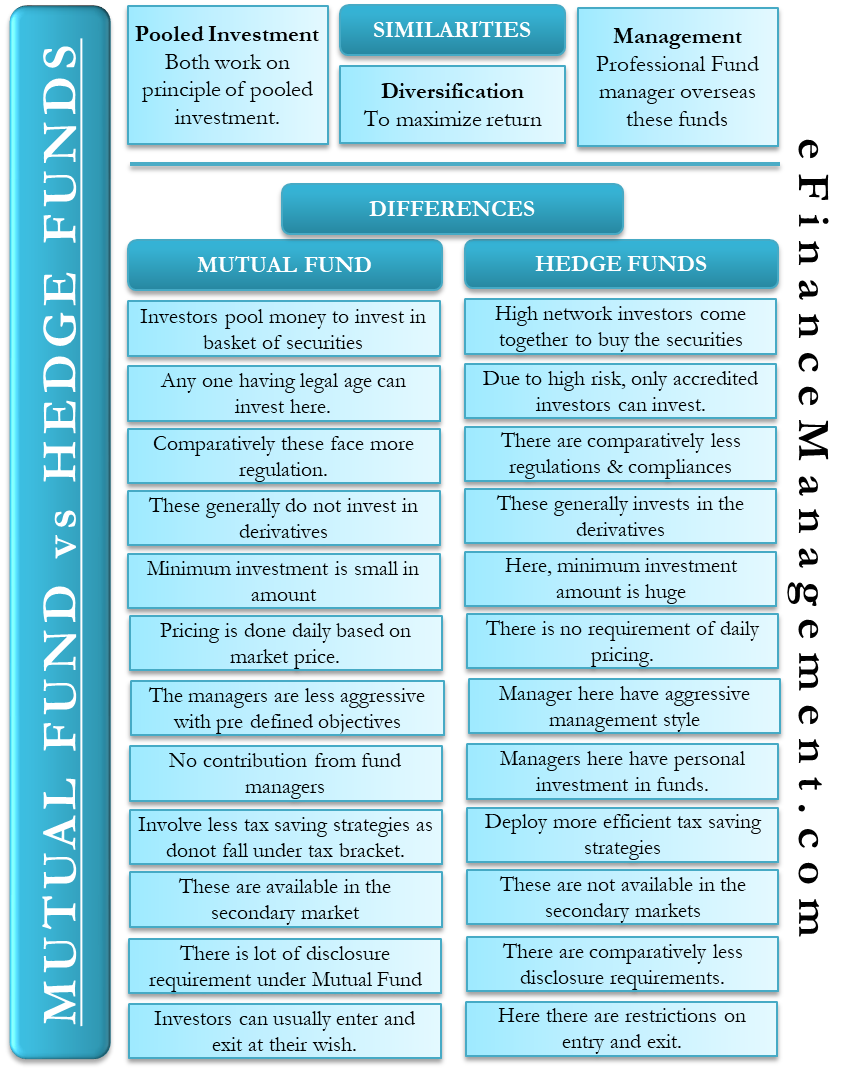

Key Differences Between Hedge Funds and Mutual Funds There are a few major differences between Hedge Funds and Mutual Funds. Hedge funds charge a set management fee usually 2 and a performance fee which is usually between 10 and 30. Mutual funds provide small investors the opportunity to invest in a portfolio of securities which is quite impossible to do with a small capital in hand.

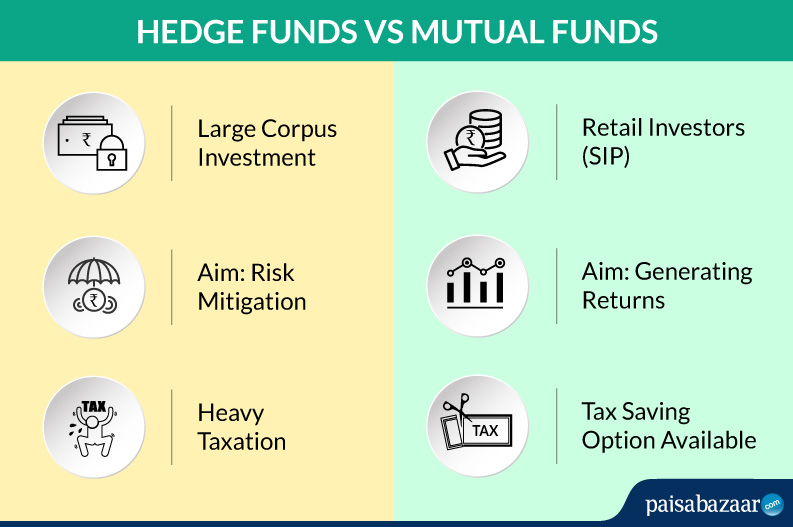

Incentives by fund type Everyone knows that good performance attracts assets. Mutual funds on the other hand stick to the shallows where they can catch smaller but more reliable returns. A hedge fund is described as a portfolio investment whereby only a few accredited investors are allowed to pool their money together to buy assets.

Thats because fund managers are limited in their ability to use. 9 rows Both the mutual funds and the hedge funds are the investment funds where mutual funds. Mutual fund fees are more heavily regulated than hedge fund fees.

Both the mutual funds and the hedge funds are the investment funds where mutual funds are the funds which are available for the purpose of the investment to the public and are allowed for trading on the daily basis whereas in case of the hedge funds investments by only the. Differences between hedge funds and mutual funds are given below while the biggest difference is that Mutual funds are highly accessible while hedge funds are not. Since mutual funds face more regulations than the hedge funds they have certain restrictions on the assets they can invest in.

The key difference between the two is that hedge funds chase the big fish investments that are high risk high reward. Hedge funds are also notoriously less regulated than mutual funds and other investment vehicles. Mutual funds on the other side stay in the shallows catching smaller but more consistent returns.

Conclusion Hedge funds go after the big fish which are high-risk high-reward investments. Hedge fund managers typically adopt more aggressive investment strategies. Hedge Fund Vs Mutual Fund The fundamental difference between hedge funds and mutual funds is.

Types of Investors 4. Mutual Funds ETFs 401k InvestingTrading Investing Essentials Fundamental Analysis Portfolio Management Trading Essentials Technical Analysis Risk Management Markets News Company News. For example hedge.

On the contrary Mutual funds are regulated investments and. Hedge fund investors can expect to pay more the better the fund performs. When comparing hedge fund vs mutual fund the most common misconception we have seen made by newbies in investing is that they all fit under the same banner which is not the case.

Mutual funds are quite a safe option in comparison to Hedge funds as they only invest in public traded companies and bonds. Although hedge funds and mutual funds may appear to be similar at a first glance they are very distinct beasts. Hedge funds are regarded as private investments and are free to trade in anything.

If you go to any one of your banks and you have a decent amount of money youll probably get a recommendation to invest your money with a mutual fund its usually one of the funds they offer. Mutual funds are priced according to their net asset value and investors can have their money upon settlement one day later. In terms of costs hedge funds are pricier to invest in than mutual funds or other investment.

Hedge funds and mutual funds are both pooled vehicles but there are more differences than similarities. Mutual funds dont charge incentive fees. Hedge funds seek absolute returns.

They can take bigger riskier bets on more types of financial instruments. Hedge funds on the other hand are under no obligation to disclose or restrict the assets in which they are investing. Hedge funds are for the wealthy and for institutions that have large blocks of money to invest.

Long-Only vs LongShort Once weve covered these differences well dive into the Investment Strategies used by Hedge Funds and Mutual Funds. Dont take share from the profit.

Mutual Fund Vs Hedge Fund All You Need To Know

Hedge Fund Vs Mutual Fund Best 9 Differences To Learn

Hedge Funds In India Know Meaning Comparison With Mutual Funds

Hedge Fund Vs Mutual Fund Vs Index Fund Which Is Better Qoodis Com

Guide To Research On Hedge Funds Part 5 The Differences Between Mutual Funds And Hedge Funds Hedge Think

Mutual Fund Vs Hedge Fund Top 7 Differences You Must Know

Mutual Fund Vs Hedge Fund Top 7 Differences You Must Know

Mutual Funds Vs Hedge Funds What S The Difference Bsevarsity Bsevarsity Com

0 Response to "hedge fund vs mutual fund"

Post a Comment